wells fargo class action lawsuit payout

Under the Settlement Defendants are distributing at least 3935 million to Class Members pursuant to an Allocation Plan and Distribution Plan. Q3 Crypto Ponzi Victims File Class Action Lawsuit Against Wells Fargo Wells Fargo Class Action Lawsuits Fargo.

Wells Fargo Account Fraud Scandal Wikiwand

Wells Fargo Loan Modification Error Caused By Wells Fargos Negligence.

. On January 13 2020 Judge Esther Salas of the US. The company has since apologized and resolved the cases. Wells Fargo Workers Receive 35 Million Settlement for Overtime Class Action.

31 2021 in the US. The bank has agreed to pay a 3 million settlement in a class action lawsuit that alleged the company incorrectly categorized bankruptcy claims. Under the terms of the settlement agreement Class Members will be automatically entered into the settlement and receive a share of 13575 million.

With Settlement Wells Fargo Has Put Scandal In The Rearview Analysts Say Wells Fargo Wells Fargo Account Car Insurance. Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP insurance coverage. Under the Settlement at least 3935 million in payments are being issued to Class Members.

Wells Fargo will pay 3 million as part of a settlement resolving a class action lawsuit that claimed the bank mishandled bankruptcy credit reporting. Each Statutory Subclass Member also will receive an additional compensation payment of up to 5. Wells Fargo has agreed to pay 325 million for self-dealing related to a 2020 class-action lawsuit involving its target date collective investment trusts which charged high fees and underperformed.

Listed in our Open Settlement directory are the other class action settlements that might be able to claim cash for you. The banks overdraft policy was found to be unconstitutional under federal law. The Class includes any merchant in the United States who contracted to receive payment.

The Wells Fargo lawsuit is a class action suit over a fraudulent practice by the company. The Wells Fargo overdraft lawsuit payout 2016 was the result of a long court battle. How Much Will I Get In The Wells Fargo Class Action Lawsuit.

As a result the bank was ordered to pay out more than 200 million to victims of overdrafts. And Wells Fargo Bank Wells. Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees.

Read More Wells Fargo Unfairly Repossesses Vehicles Class Action Lawsuit Says. 667M Bank Fees Class Action Settlement Reached with Chase Wells Fargo BoA A 667 million settlement has been hashed out on behalf of millions of consumers and the banks accused of conspiring with credit card companies to inflate their ATM. Allocation Plan payments are being issued and mailed directly by Wells Fargo on a rolling basis.

In the end the company was forced to reimburse overdraft victims 203 million in refunds. Wells Fargo denies any wrongdoing or liability. Wells Fargo has agreed to pay 325 million to settle a two-year-old case.

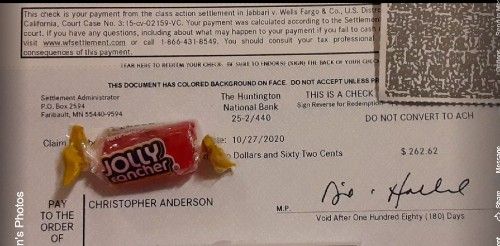

April 5 2022 413 pm ET. Let Top Class Actions know when you receive a check in the comments section below or on our Facebook page. Wells Fargo Co.

A 67 Million class action lawsuit was brought on behalf of ATM cardholders who used a bank ATM owned by an entity different from the entity that issued the ATM card and were assessed an ATM surcharge. Wells Fargo will pay 500 million to end a class action lawsuit refunding US. Welcome to the Informational Website for the Wells Fargo CPI Class Action Settlement.

The fines led to a drop in profits by almost 20 billion. View All Wells Fargo Class Action Lawsuit and Settlement News According to Class Action Lawsuits These Are The Worst Banks in America Final Approval Given For 28 Million Settlement Between Wells Fargo Customers Who Claim They Were Recorded Without Consent. The settlement benefits individuals who had a credit card account direct auto account home equity line of credit account or personal line account with Wells Fargo that was charged off meaning the grantor wrote.

Ultimately Wells Fargo denied the class action lawsuits allegations but agreed to pay 185 million to settle the dispute. District Court of Oregon the two plaintiffs alleged that Wells Fargo failed to comply with the RESPA and Regulation X by not. A 10536098 Settlement has been reached in a class action lawsuit that alleged that Wells Fargo improperly assessed overdraft fees arising from non-recurring transactions for UberLyft rides by customers who did not opt into Wells Fargos Debit Card Overdraft Service.

A 40 million Wells Fargo Merchant Services settlement will benefit certain merchants who contracted with the company for payment processing services. Wells Fargo to Pay 325 Million to Settle Lawsuit Over Its 401 k Plan. For the 394 million settlement Wells Fargo is estimated to pay 385 million and National Guard will cover the remaining 75million.

Negotiations have been hard according to the customers requesting approval for the class action settlement. Wells Fargo has worked to identify and provide remediation to all. Three Defendants have agreed to settle the lawsuit JPMorgan Chase Co.

The company had to pay out 1 billion to other regulators after it was caught. District Court for the District of New Jersey granted final approval of a settlement of a federal overtime class action lawsuit against Wells Fargo Company which was brought on behalf of employees. The suit was filed in May 2015.

Wells Fargo says it already paid out more than 33 million to members of the Statutory Subclass between December 2018 and March 31 2021. The class action lawsuit we filed alleges that Wells Fargo failed to implement and maintain the proper software and protocols to correctly determine whether a mortgage modification was required under federal regulations. In the class action lawsuit filed on Jan.

Nearly 36 million will be paid out to borrower attorney fees and 500000 will cover attorney expenses. The bank has agreed to pay 185 million to resolve the allegations. The Wells Fargo lawsuit resolves claims of fraudulent activities involving unauthorized accounts forged signatures and unauthorized services.

The lawsuit also alleges that Wells Fargo knew of the error.

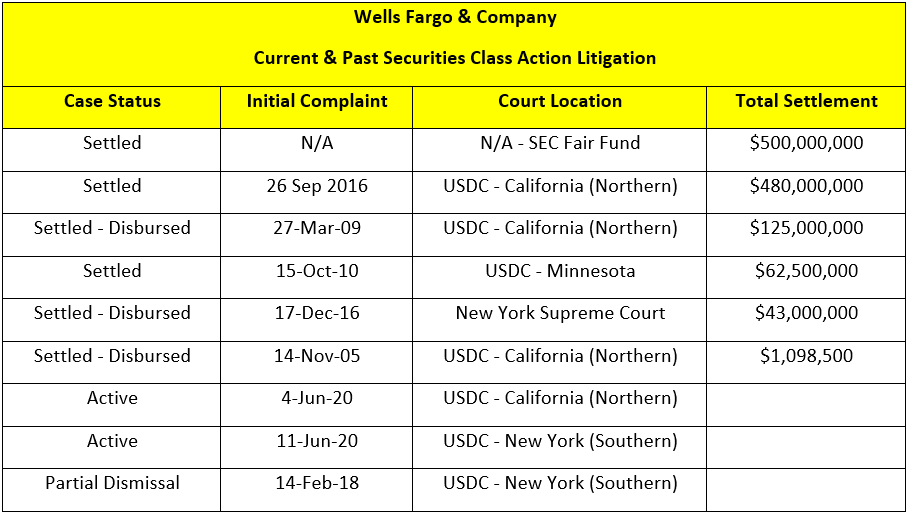

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Settles Phony Account Securities Suit For 480 Million Wells Fargo Sales Strategy Creation Activities

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

Even More Predatory Actions On The Part Of Wells Fargo This Time It S Allegations Of Unauthorized Stealth Mortgage Modifications Wells Fargo Fargo Wellness

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

Wells Fargo Robocall Text Spam Class Action Settlement Top Class Actions

Wells Fargo Jpmorgan Among Banks Sued Over Sba Virus Loans Bloomberg

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Www Wellsfargocpisettlement Com Class Action Lawsuits Tech Company Logos Wells Fargo

Wells Fargo Agrees To Settle Auto Insurance Suit For 386 Million The New York Times

Four Settlement Checks In The Mail Top Class Actions

Wells Fargo Reverses Plan To End Personal Credit Lines After Customer Backlash

Wells Fargo Merchant Services Review Fees 2022

A Black Homeowner Is Suing Wells Fargo Claiming Discrimination The New York Times

Wells Fargo Agrees To 28m Settlement Over Call Recordings Top Class Actions

Wells Fargo Is A Hot Mess It Has Only Itself To Blame Cnn Business